If you are searching so you can refinance your property loan for taking virtue out-of benefits like straight down rates, additional possess, or even access domestic equity, you’re questioning just how long do the procedure get.

I explore this new detailed process of refinancing, the average time frame we provide, and also the data you need useful if you decide so you’re able to refinance your home mortgage.

Normally, you can expect the whole refinancing strategy to get between three days so you’re able to 6 weeks with regards to the lender together with complexity of the financing.

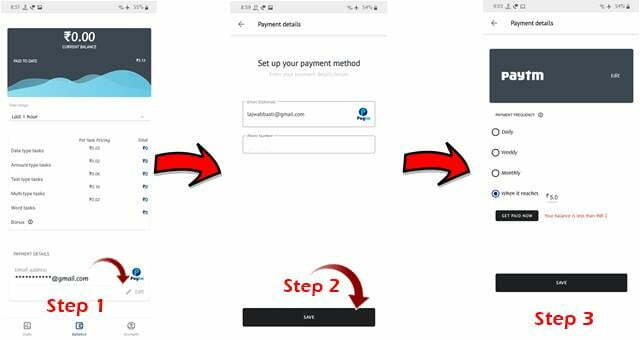

If you’re questioning whether or not you will find everything you will perform so you’re able to speed up the process, listed below are some choices:

Some days, particular loan providers may offer your an instant refi ; this action boosts committed it requires to help you re-finance the financial by using insurance coverage to allow lenders to help you payment your own mortgage without having the hassle away from waiting for your existing financial to step the discharge.

Towards the FastTrack Refi system, i pay-off your own dated mortgage before sending one records so you can discharge the borrowed funds. It means you start protecting to the desire and you can repayments very quickly. Since you come back the completed financial data files and you will Mortgage Agreement to help you all of us, it takes only months to switch.

The brand new refinancing procedure performs similarly because applying for your brand new financing this is why it fundamentally uses up so you’re able to 6 weeks.

Evaluate precisely why you must re-finance and ultimately should it be your best option. This will help you and your home loan bank restrict and therefore loan sorts of and interest rate tend to suit you.

In addition should discover your financial predicament as well as how refinancing will help you to in the long term. Opinion your interest in addition to go out you have got leftover on your own latest financing in place of repaired and you will adjustable speed selection to your the market industry to work out exactly how various other your payments could well be.

While you are thinking about adhering to your current bank, correspond with all of them regarding other offered loan products that may fit your. Insurance firms a speak to them, they could to provide a far greater package and you may eventually save you pressure off switching lenders.

Or if perhaps you are considering altering, do a little thorough browse to see which loan providers are offering competitive costs, that helpful features, and just how its refinancing techniques works.

If you are proud of brand new mortgage you have opted, the next step will be implementing and therefore works similarly to your own modern loan application.

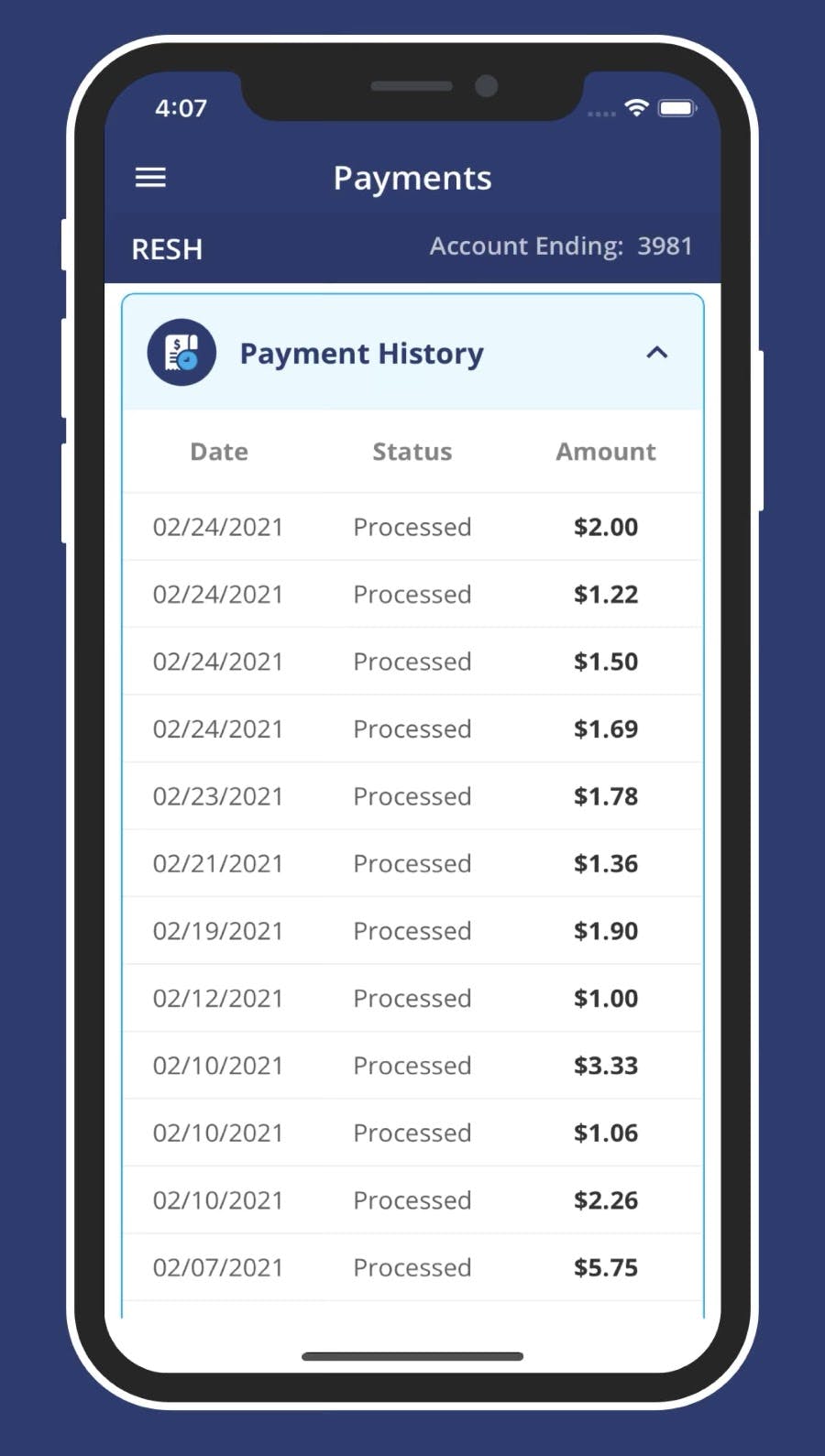

Definitely have got all the relevant safe loans files readily available such as for example once the payslips, three months regarding bank statements, rental income research, ID, any mortgage comments, a duplicate of rates notice, and you can 6 months of your latest financial comments.

Your brand-new financial may need a property valuation of your home. Assets valuation is used in order to assess a borrowers LVR. In which LVR is more than 80%, Lenders Financial Insurance (LMI) required. Your own bank will generally be looking over to see if your own assets has grown otherwise diminished inside worth which can impression their security.

Once you have started because of the A-Okay’ we.age. their lender possess checked the papers and deemed your credit history since high enough, the loan might be acknowledged.

Generally, an instant refi will see you improvements to that final stage within this 72 instances while the important processes time might take whenever 2 weeks.

After you have gotten your own approval, you will get their settlement big date where your lender have a tendency to program to repay your current financing. When so it goes through, you will technically begin making mortgage repayments to the new house loan lender.

Most of the time, people decided to refinance in order to safe better interest levels, located additional features including offset sandwich-levels, button financing sizes, and many more.

Circumstances in the man’s individual lifestyle for example a different employment, kids, and you may monetary setbacks are numerous most other factors people plan to refinance their home mortgage.

Prior to deciding whether or not we need to re-finance or perhaps not, consider if the future deals you are able to gain will provide more benefits than the fresh upfront costs. This can include break charges, software charges, possessions testing fees, LMI charges, plus.

For those that are considering renovating otherwise selling their house sometime soon, refinancing may not be the right choice to you.

When the refinancing your house financing is on your mind, definitely think about your entire solutions and setting a beneficial choice that suits your needs and points.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile