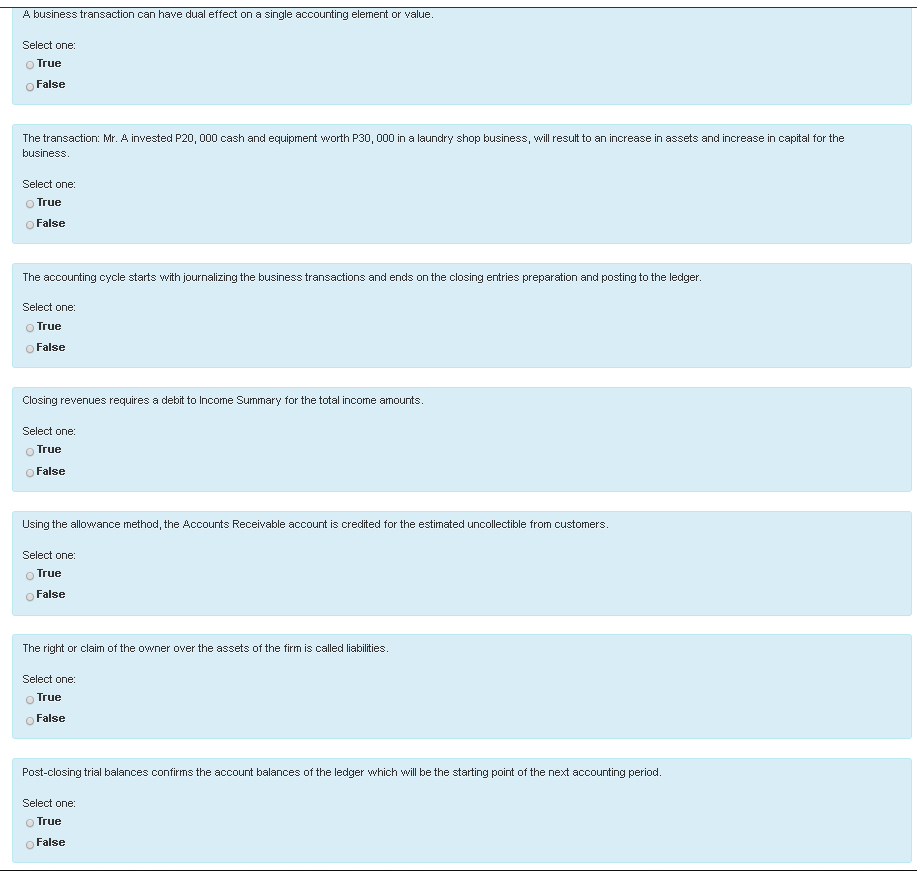

Under the double-entry system, both the debit and credit accounts will equal each other. The dual aspect concept of accounting relates to the idea of double entry bookkeeping.Every transaction affects the business in at least two aspects. After the transaction, $100 will get deducted from B’s bank account while A’s bank account will gain $100. Hence, the dual aspect concept requires transactions to be recorded in two different accounts.

The dual aspect concept forms the basis of double-entry book-keeping in accounting. In double-entry bookkeeping, each transaction will result in one account gaining something while the other losing something. Double-entry accounting systems can be used to create financial statements (such as balance sheets and income statements), which can give insights into a company’s overall performance and health. Accounts payable is money that you owe to other people, and in double-entry bookkeeping, it’s considered to be a liability. When you defer an expense, you record the expense as a debit, and then, you record the amount due as a credit in your accounts payable journal.

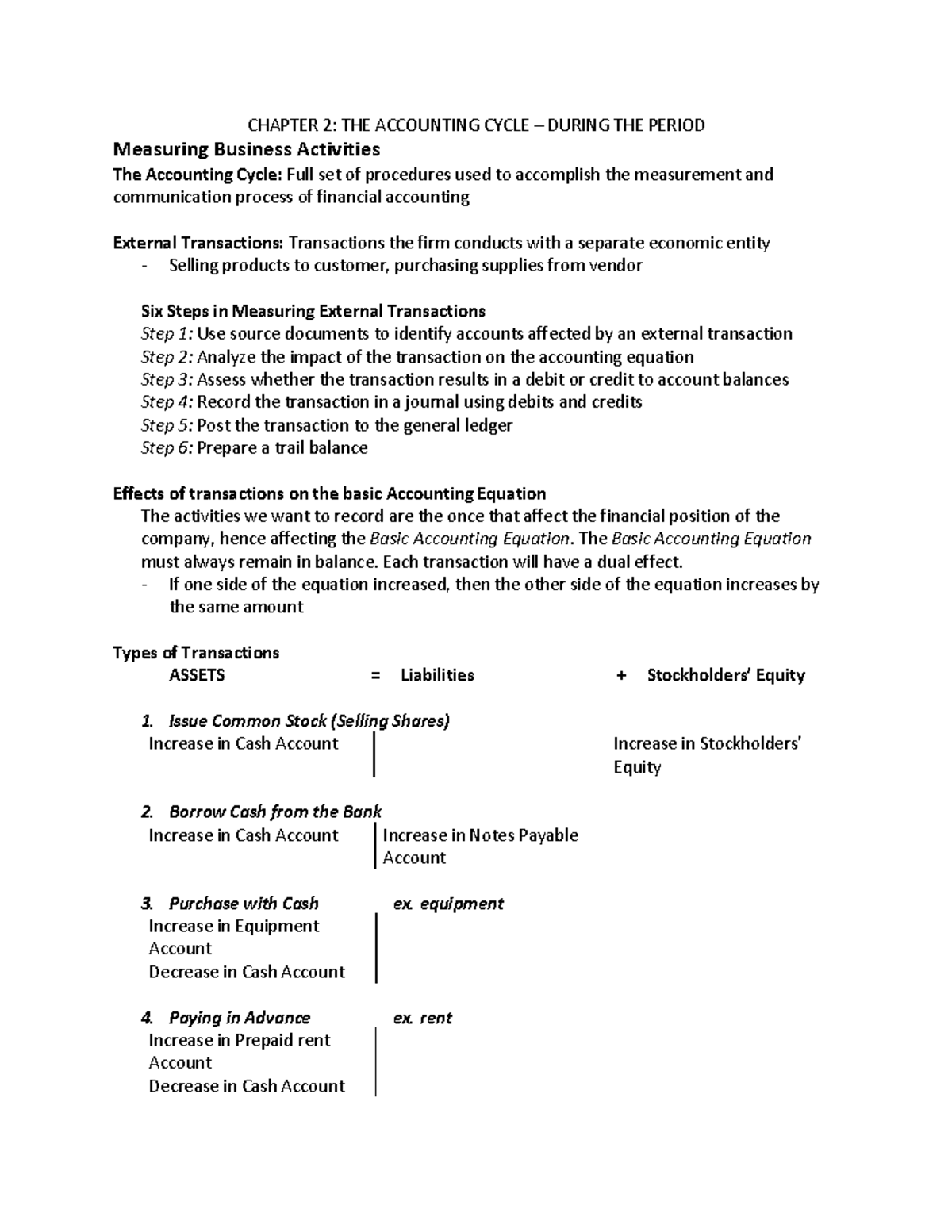

Debits increase asset accounts and decrease liability and equity accounts. Credits, on the other hand, increase liability and equity accounts and decrease asset accounts. Understanding how debits and credits impact various accounts accounting, cpa and tax prep houston is essential for accurate recording. For instance, a debit to a cash account signifies an increase in available funds, while a credit to an accounts payable account represents an increase in obligations to creditors.

Accurate financial reporting is vital for stakeholders, including investors, creditors, and regulators, as it enables them to make informed decisions based on trustworthy data. The accuracy and consistency of recording transactions form the bedrock of reliable financial data. Errors or inconsistencies can ripple through subsequent calculations, leading to skewed financial statements and misguided decisions. Maintaining precise records ensures that a company’s financial health is accurately portrayed, strengthening trust with stakeholders, investors, and regulatory bodies. Additionally, consistent recording facilitates easy audits, enables trend analysis, and supports proactive financial management.

The first accounts of the double entry bookkeeping system was documented in 1494 by Luca Pacioli, a Franciscan monk and hailed as the Father of Modern Accounting. Capital can be defined as being the residual interest in the assets of a business after deducting all of its liabilities (ie what would be left if the business sold all of its assets and settled all of its liabilities). In the case of a limited liability company, capital would be referred to as ‘Equity’. From a business perspective, expenses and gains play a pivotal role in determining the financial health and profitability of an organization. Expenses refer to the costs incurred by a business in its day-to-day operations, such as salaries, rent, utilities, and raw materials.

The successful case studies we’ve examined demonstrate how dual effect accounting has helped businesses achieve greater accuracy, transparency, and efficiency in their procurement operations. It has enabled them to make more informed decisions, improve cost control, and optimize supplier relationships. When discrepancies occur, accountants must meticulously review each entry to pinpoint and rectify errors.

A Proposed reaction mechanism for the formation of vinylboronate esters catalyzed by microcrystalline Cu4NC. A Deuterium experiments of the Cu4NC-catalyzed hydroboration reaction in the mixture solvent (CD3CN/H2O). B Deuterium experiments of the Cu4NC-catalyzed hydroboration reaction in the mixture solvent (CH3CN/D2O). C Deuterium experiments of the Cu4NC-catalyzed hydroboration of phenylacetylene-d1. Traditional spreadsheets, though still in use, are swiftly being replaced by these modern solutions.

GoCardless can help, integrating with over 350 partners including top accounting and invoicing software like Xero and Salesforce for a joined-up workflow. As invoices are paid and payments received in your bank account, your financial records are automatically updated accordingly. The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile