Self-functioning homebuyers in place of two straight many years of worry about-a position taxation statements can only just wait it. The coming year, when they have a couple of years from taxation statements to exhibit, capable fill out a unique loan application.

Or, self-employed homebuyers who wish to feel home owners immediately payday loans – New Jersey – as opposed to wishing another seasons — is examine these home mortgage options.

Non-QM mortgages do not fit a certain loan system. They’re not traditional loans, and they’re as well as perhaps not regulators-insured mortgage loans such as USDA, Va, otherwise FHA financing.

As the low-QM lenders don’t need to go after any agency direction, they can make very own regulations. Consequently, you are capable of getting a non-QM financing enabling one seasons out-of notice-a position earnings.

In return for it independence, anticipate paying large rates of interest. Additionally, you will need to make more substantial advance payment and you can meet higher credit score conditions. Recall you’re able to refinance to help you a beneficial all the way down price later on, once you normally qualify for more traditional money.

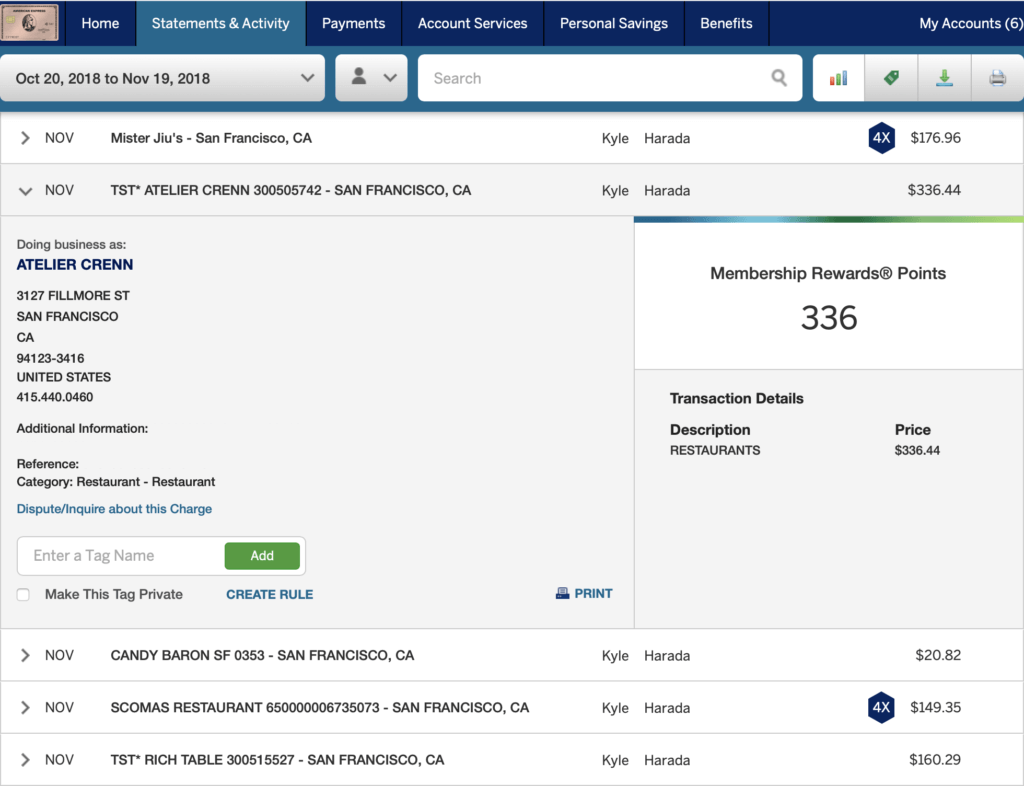

Some mortgage brokers commonly check your lender statements observe the previous cashflow. Those funds circulate, along side other proof lingering team earnings, you certainly will bolster your own funds on sight off a loan provider.

Like other low-QM fund, a bank report loan you will definitely want a larger down-payment, a stronger credit rating, and you will a lower financial obligation-to-earnings ratio (DTI). A high mortgage price is also probably.

If you are not doing so currently, contain a co-debtor on application for the loan. Their co-borrower’s earnings you will definitely provide the balances loan providers are seeking, improving your odds of acceptance.

A beneficial co-signer otherwise non-tenant co-borrower may also boost your loan application versus to-be a co-holder of the home. The newest co-musician create commit to get obligations for the personal debt for people who don’t make your mortgage payments, which is a fairly huge inquire.

By using an excellent co-signer, it is possible to re-finance into the an alternate loan, deleting the new co-signer on financial, for those who have two years cash taxation statements to display a lender.

Mortgage officers understand particulars of qualifying having an effective mortgage. That loan officer helps you evaluate other measures, leading one to the new worry about-a career home loan one to best suits your unique means.

If or not you have been notice-useful 12 months, three years, or even for decades, the cause of month-to-month earnings is only one bit of your own financial qualifying secret. Loan providers along with see these items:

When you find yourself mind-operating, you could increase your qualification because of the become a healthier candidate inside the these types of other areas of your earnings.

Making a much bigger-than-necessary downpayment, paying down private expense, and you can ensuring that you may have higher level credit (or at least a good credit score) can help a great deal. It will also help if you have extra cash from the financial, beyond what you need for your down payment and you can closing costs.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile