Using a home collateral mortgage to find several other house is merely you to highway borrowers takes. Listed below are some other choices for using collateral buying a special household.

A money-away refinance is a sure way to buy various other assets using guarantee. A cash-out re-finance accomplishes a couple needs. Very first, it refinances your current mortgage within industry prices, probably lowering your interest. Next, they rewrites the borrowed funds harmony for more than your already are obligated to pay, allowing you to leave that have a lump sum payment to utilize on the new home purchase. Delivering security regarding a property to purchase other with a good cash-aside refinance could be more advantageous than many other possibilities as the you’ll be able to has just one financial rather than one or two. However, rates to your dollars-away refinances are generally more than basic refinances, and so the actual interest rate should determine should this be a an effective flow.

Property security credit line (HELOC) is another selection for using domestic guarantee to acquire a unique home. HELOCs are similar to home equity money, but alternatively of acquiring the borrowed funds continues initial, you have a credit line that you supply inside loan’s “mark several months” and pay during the installment months. This procedure of using security to order investment property can be beneficial when you’re “family turning” since it makes you purchase the assets, pay money for renovations and you may pay the latest credit line in the event that assets offers. Although not, rates on the HELOCs are usually varying, so there is a few imbalance with this solution.

Property owners 62 or older possess a supplementary option of having fun with security to shop for the second household – a house Collateral Conversion Home loan (HECM)monly known as an opposite financial, an excellent HECM lets consumers to gain access to household equity in place of and make repayments. As an alternative, the borrowed funds are repaid after you leave your house. Opposite mortgage loans provide an adaptable way of playing with collateral purchasing other house, as individuals can choose between searching a lump sum or an excellent personal line of credit. Yet not, just remember that , when you wouldn’t make payments having a great contrary financial, appeal often accrue. This leads to the borrowed funds equilibrium to expand and certainly will end in dinner up all the home’s equity.

Article Notice: The message from the blog post is dependant on brand new author’s feedback and you will pointers alone. It’s got maybe not come previewed, accredited otherwise supported of the any of the network people.

Completa i campi per ricevere un preventivo

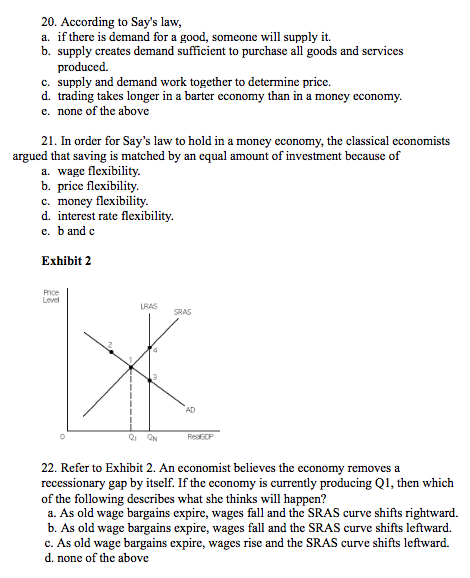

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile