Whenever financial support higher sales, like property or vehicle, you often need assistance regarding elite brokers and you may lenders. There are a lot to select from title loan Alabama now, but two of the top people within world is Quicken Fund and you may LendingTree.

Each other lenders render added convenience which help speed up it will times difficult techniques, however, which is most beneficial? Let us need a much deeper glance at its organization profiles and see where the strengths and weaknesses sit.

One of the leading differences when considering Quicken Funds and you can LendingTree is the way they efforts. Lending Tree will act as an agent, handling loan providers right to select borrowers best offer. Because obtained generated connections with different lending companies, discover so much more financing possibilities.

Despite having a lot more loan options, even in the event, there clearly was a risk of this new representative not aligning to the interests of your own debtor. It ple, that maximizes its settlement amount as opposed to picking out the lowest speed you are able to.

As well, LendingTree operates on such basis as good-faith quotes . As they try quite alongside what you could score from additional lenders, they are not particular. The added go area with respect to pricing is thus challenging whenever you are on a tight budget and require appropriate quotes.

Alternatively, Quicken Loans acts as the financial institution personally. The middle guy is actually taken out of the fresh new picture. Info is remaining personal, so that the probability of bringing swamped having calls out-of multiple loan providers try no.

But not, because Quicken Loans doesn’t work having several lenders, it could be very hard to help you detect in the event that an available rate really is the reasonable price readily available. This makes it paramount for individuals to know what type of financing is considering as well as have accustomed the brand new words relevant with it.

In which Quicken Loans just has the benefit of mortgages and you will refinancing possibilities, LendingTree now offers a multitude of mortgage items. They’ve been vehicles, scholar, personal, team, and you may mortgage brokers. Securing every type is an easy techniques, in which you fill out specific individual and you will monetary suggestions. After the right information is registered, profiles gain access to several also offers out-of genuine loan providers.

Within the per financing group to possess LendingTree, there are all kinds of choices. Like, with home loans, pages is also safe FHA, Va, home collateral, and you can household re-finance financing. With so many options to pick from, consumers is select the primary loan that works for their novel state.

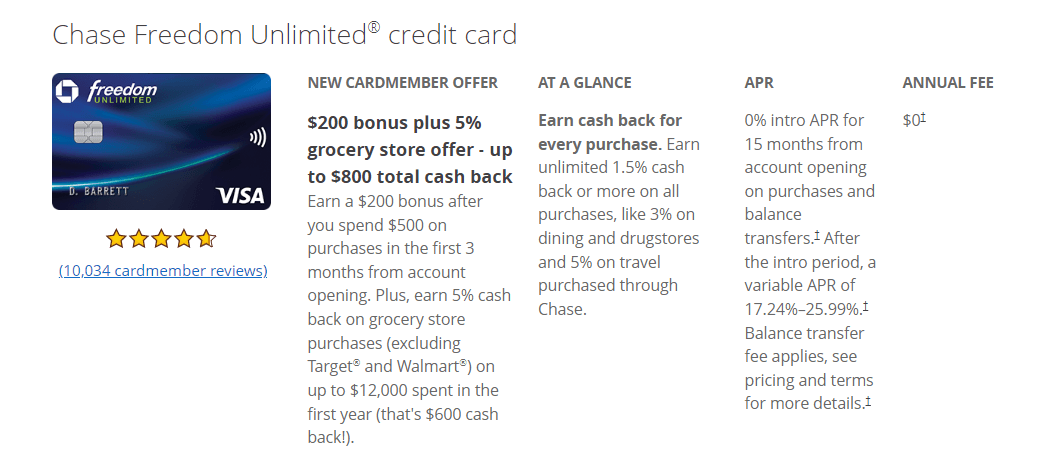

LendingTree also offers a platform you to allows profiles evaluate charge card also provides. Some notes element cash back, although some has take a trip perks. Handmade cards evaluations can also be found courtesy fico scores, between reasonable so you can higher.

As mentioned before, Quicken Finance focuses on refinancing a mortgage and you will mortgage brokers. They’ve got mastered its mortgage processes and have not stretched by themselves also slim so far as offering too many financing brands. Getting lenders are a far more effective procedure because good result, out of entry the application form so you can closure on a prospective dream home.

Bringing a loan is often a complicated and you may tiring process, and there is way too many products which go into it. That’s what helps it be so important locate lending firms that offer higher customer service. Even though difficulties develop, a beneficial customer support assists diffuse pressure and you will difficult activities. So how create LendingTree and you can Quicken Funds pile up in the customer service agencies?

Earliest with the deck was LendingTree. Its customer service representatives was prompt in getting to individuals, that is very important during such as for example a requiring go out. However they is actually lead with their guidance and a reliable as much given that call-backs. not, they are certainly not in a position to address any insights out-of loans while the you to definitely data is mainly recognized because of the loan providers.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile