If you’ve never ever heard about a great USDA mortgage, you aren’t alone. In fact, you could actually label the many benefits of USDA finance a highly-leftover miracle. Well, not any longer!

New USDA financing are a no-off financial choice open to a massive portion of the United Claims. USDA money are built from the private loan providers and secured by You.S. Service from Agriculture (USDA). He is open to homebuyers in the less industrialized elements since the an effective way to raise homeownership inside the outlying elements.

USDA fund performs exactly like other regulators supported mortgage choice. Homebuyers will work that have a beneficial USDA lender, become preapproved, setup a deal for the a property, look at the USDA financing appraisal, financial underwriting ultimately on to closure.

Because $0 off advantage is vital, such regulators-supported funds render many most other large pros, as well. Here are 10 affairs and you can benefits associated with USDA money that might wonder your.

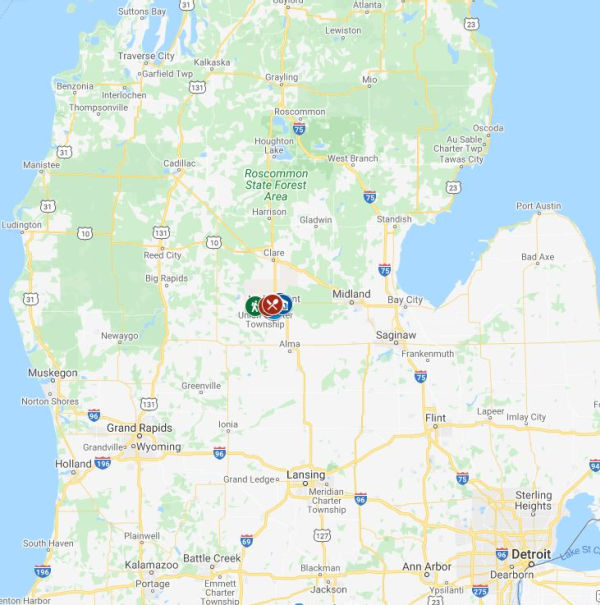

You can purchase having a beneficial USDA mortgage just when you look at the an experienced rural town, however, many everyone is astonished knowing the USDA describes rural. Basically, predicated on their guidance, it offers any portion having a people out-of below 35,000. Actually, an estimated 97 percent of the U.S. is eligible to possess USDA lending.

Very if you do not have your places set on the vibrant lights from an urban area, you are probably in luck to help you be eligible for a great USDA financing. These types of money aren’t just having outlying portion or farmers.

![]()

Looking a nice second family if you don’t accommodations property? Disappointed, a good USDA mortgage are not for your requirements. Since if you happen to be inquiring, Was USDA funds only for primary residences?, the clear answer was yes. What’s needed declare that it ought to be used in an excellent number one home, in your geographical area all day long.

Once you pay attention to outlying, you might be considering a large ranch or lots of miles, but that isn’t the scenario. USDA fund shelter any sort of form of dwelling you will be interested in, out of the latest framework and existing unmarried-household members land so you can are produced otherwise modular homes and even apartments and you will townhouses.

When you are USDA money commonly per possessions, they’re not for every budget, sometimes. New USDA and lenders think about your family income when researching the qualification. Fundamentally, you simply cannot create over 115 % of your area’s median income.

Loan providers will look at complete house earnings, as well as individuals who will not be compelled towards new financial, but there are many accredited write-offs which might be deducted.

USDA earnings limits reflect the expense of way of life and certainly will differ according to where you are purchasing, how big all your family members and a lot more.

Thank goodness that you could nonetheless receive an excellent USDA mortgage just after bankruptcy or foreclosure. Overall, USDA recommendations require a beneficial three-seasons wishing period becoming qualified to receive a good USDA financial once a section 7 case of bankruptcy or a foreclosures. Particular loan providers could be ready to host exclusions for unique instances, but men and women are always a case-by-instance testing.

The new waiting months once a section thirteen personal bankruptcy is one season, provided you made 12 months’ property value with the-day costs according to the pay plan which had been oriented during the the fresh new personal bankruptcy process.

After you look for a conventional home loan while making a deposit from lower than 20 percent, the financial have a tendency to request you to pay something called individual mortgage insurance rates (PMI) to guard their resource. However, traditional PMI is costly, running about 0.5 to a single % of your own entire loan amount a-year. Therefore, when you yourself have an effective $200,000 financing, that PMI percentage you can expect to manage a pricey $2 hundred 30 days.

USDA home loan insurance is far more sensible. You are able to shell out an initial percentage of 1 percent of the loan matter, following a yearly mortgage insurance coverage fee comparable to 0.thirty five % of your own mortgage harmony. The like that same $two hundred,000 mortgage, you can easily shell out $dos,000 initial and you may $58 monthly. USDA customers can financing the initial payment in their mortgage.

Because USDA does not indicate the absolute minimum credit rating, the lender which helps to make the financing will likely wanted a cards score off 640 or higher. That is the matter that’s needed is to use this new USDA’s Secured Underwriting System (GUS), that was made to speed up the whole process of borrowing chance assessment. For those who have a get below 640, a lender would have to yourself underwrite that loan, whenever they want to grant they.

Given that valuable hyperlink the common credit score to own a normal financing try in the 720, such financing is advisable for someone that specific blemishes to their borrowing.

An excellent co-borrower was someone who cues on dotted range along with you, in effect stating they are going to deal with the borrowed funds if you avoid paying. That have a good USDA financing, it’s not necessary to play with a co-borrower it can be useful if this enables you to meet with the money criteria or improves your own creditworthiness. Note that the fresh new co-debtor need to be a person who existence along with you, and they will have to meet with the exact same credit, income and you can debt guidance as you.

One of the benefits out of USDA fund would be the fact you will find zero punishment getting prepayment. Although it appears hard to believe that you would spend so much more to repay the loan, particular lenders require you pay a penalty for folks who repay the loan before a specified big date. However with an excellent USDA financing you may have no pre-payment penalty, for example for folks who re-finance, promote your property otherwise win the new lotto, you might pay off the loan once you such as for instance.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile