Even although you can afford a hefty down-payment, coupling they with closing costs could make it difficult to come with the cash you desire to own a bank statement home loan. The typical debtor will pay anywhere between step three per cent and you will four percent regarding your house loan amount in conclusion get a loan with no credit Aspen will cost you.

Making use of the analogy more than, closing costs to the a great $450,000 mortgage are anywhere between $13,five-hundred and you can $twenty two,five hundred. So, that have a down payment out of 20%, or $67,five hundred, expect to come out of wallet from around $81,000 to $ninety,000.

Only a few loan providers give financial declaration financing. Even though you when you look at the old-fashioned financial institutions and you will credit unions, several loan providers an internet-based lenders carry out offer they.

Candidates need at the least 24 months regarding organization experience and self-employment money. When you’re men and women parameters could be the standards, certain loan providers have more good conditions, while some might require extra experience.

Self-working someone have a more difficult date providing conventional funding. Lender declaration fund is viable choices, but it’s good to know how they will perception your money.

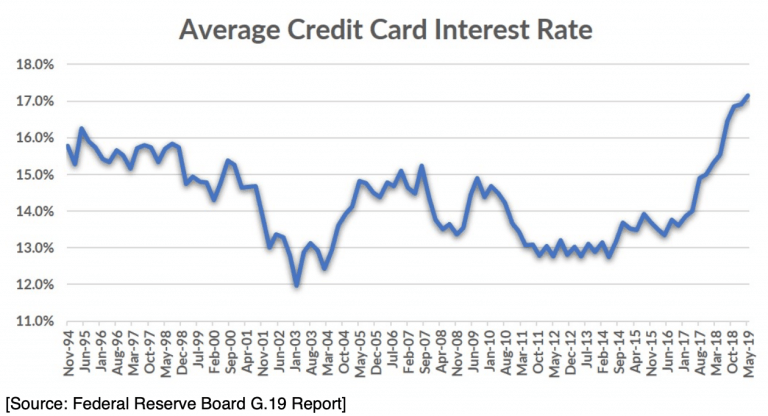

Such fund be more costly employing highest interest rates and also require large down money. Yet not, you can purchase acknowledged even if you have less than perfect credit or a high LTV proportion and do not want to inform you any one of your own tax statements.

The latter virtue is essential to own care about-operating pros. Of a lot advertisers explore income tax deductions to save cash to your taxes. Although this is a regular approach, it minimises your taxable earnings. Really lenders make use of your nonexempt money to evaluate as much as possible pay the month-to-month loan repayments, and so the financial statement loan is a valuable funding for folks who renders the higher advance payment.

Team and personal lender report financing stick to the exact same strategy, but loan providers examine comments out-of various other account. To own a business bank declaration loan, loan providers will feedback for the past twelve-24 months of your own providers bank statements. To locate approved to have your own financial declaration mortgage, the financial institution need to study your lender statements inside the prior several-2 years.

Lender declaration fund are difficult discover due to the fact not all loan providers promote all of them. Therefore, loan providers giving such home mortgage wanted larger down costs and regularly charge higher rates.

A bank statement mortgage is ideal for your if you do n’t have a constant money otherwise cannot get proof of earnings off a manager. Like, another anyone or independent masters are able to use a financial report loan:

You can buy a financial declaration financing of Angel Pine Financial Alternatives, an internet lender that provides a multitude of mortgage software.

Other than lender report money, in addition there are antique mortgage loans such USDA money, FHA fund, and you will veteran mortgage brokers. Additionally, some non-QM mortgage products are along with readily available, in addition to investment qualifier funds, trader cash flow fund, Jumbo, overseas federal applications, and profile discover mortgage brokers.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile