If you have the complete Virtual assistant entitlement, you don’t necessarily need certainly to lay any cash down, but this might change depending on just what house appraisal suggests. This really is one more reason why should you work at a great bank having expertise in Va financing.

Their realtor should be able to make it easier to predict exactly what the domestic assessment looks such as. Unless you want to overpay getting a property, as it can certainly have an impact on your house assessment and you may your own financial, you need to work closely with your real estate professional while making sure you place forth a reasonable offer.

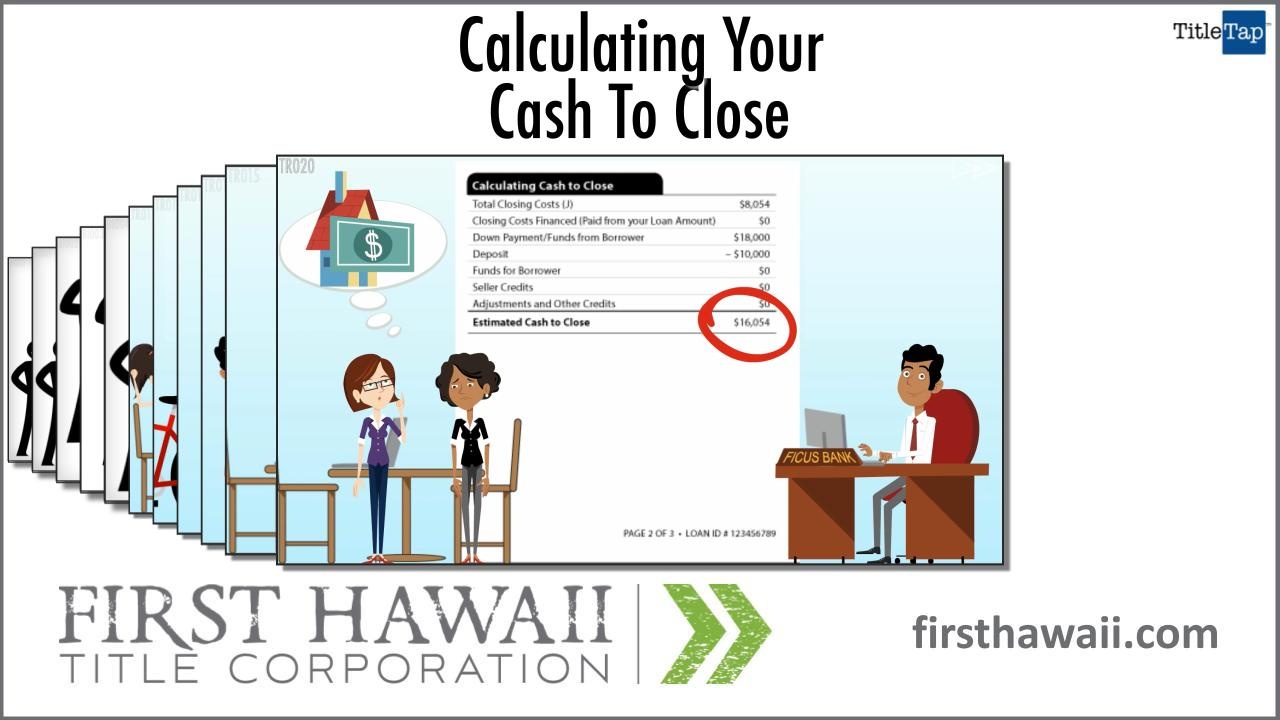

Eventually, since appraisal moved as a result of therefore the money might have been signed, you could relocate to the new closing dining table and get your new domestic. Your lender tend to finish the investment techniques, the sales are going to be finalized, and you should know about the new terms of your home loan. Your own bank will work together with your agent and the closure attorney to be certain all of the papers is within purchase, and you may get the keys to your house.

If you decide to sign up for an effective Va financing, it takes many loan providers between 40 and you may fifty days to glance at the procedures and finish the process. But not, at the Griffin Financial support, we try to shut into Virtual assistant fund in 30 days otherwise shorter. By the streamlining the process, leverage the technology, and you will drawing towards years of feel, we could speed up new Virtual assistant financing process schedule and you will rapidly get mortgage accepted.

Just what happens between once you submit an excellent Virtual assistant loan application of course you have made acknowledged? There are a lot of reason this new closing processes can get devote some time. Several tips are:

If you would like improve this new Va home loan procedure, you really have way too much control. There are activities online payday loans Wray to do to access the closure dining table more easily. Several of the most extremely important info that may help you improve the fresh Virtual assistant financial techniques is:

The brand new housing market moves easily, while you don’t want to risk lost your fantasy household, you should get your Certification out of Qualifications as quickly as possible. This is equally important into the Virtual assistant financial processes, as you will be unable to rating funding from Institution out of Veterans Issues without one.

Your COE may take sometime to acquire, and even though you should be diligent towards Va, you ought to start the process as early as possible. By doing this, you don’t invest more looking forward to your loan to become approved than you have got to. The earlier your request the COE, the sooner you could start thinking about property.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile