If not be eligible for Virtual assistant or USDA zero down payment home loans, there are other actions you can make use of to minimize this new off payment you may be necessary to shell out. You may seek help as a consequence of certain downpayment advice programs or off someone you care about.

It allow it to be off repayments as low as step 3.5% and also quicker strict credit criteria, causing them to advisable having very first-big date homeowners or people with rugged borrowing from the bank records.

Such mortgage loans come with both an upfront mortgage top regarding step one.75%, together with an annual superior that equals anywhere between 0.45% and you can step 1.05% of your own loan amount.

Mortgages you to follow Federal Housing Financing Department financing restrictions and you can elements put from the Fannie mae and you will Freddie Mac is understood as compliant funds. By using these mortgage loans, you can get a property in just 3% down.

So you can be considered, you might have to be an initial-big date homebuyer otherwise fulfill money limitations to suit your urban area. Conforming financing also require a credit rating of at least 620 and you may, if one makes a downpayment off below 20%, your I).

These types of are different extensively, so be sure to research rates and compare a number of options if the this is exactly something you’re looking for. You can search so you’re able to finance companies, credit unions, home loan people, and online loan providers to own choices.

Towns, state property organizations, and you will regional nonprofits sometimes give advice applications which can help you https://paydayloancolorado.net/meridian-village/ cover the expenses of deposit or settlement costs.

These may can be found in the form of features, and therefore don’t have to be paid back, or lowest-focus financing, that you’ll gradually pay off throughout the years. In many cases, this type of funds tends to be forgivable as long as you are now living in your house to own a specific period of time.

To ensure your qualify for a zero down payment mortgage, focus on having your credit history during the an effective lay. If it is below the 620 in order to 640 mark, you could potentially pay down the money you owe, disagreement errors on your credit report, otherwise request a line of credit increase to change their score. Investing your own costs punctually helps, also.

It’s also wise to decrease your debt-to-earnings proportion – or the show of the money their total month-to-month obligations money take up. This will make your less risky in order to lenders (you really have less obligations and will also be expected to build your costs) that will make it easier to meet the requirements.

In the end, assemble enhance financial records, including your W-2s, pay stubs, financial statements, and you can early in the day taxation statements. Their lender will need these to understand what you can be considered for.

However won’t need a down-payment having USDA and you may Va loans, they don’t come free of charge. One another finance need upfront fees (capital charges getting Va funds and verify charges having USDA financing). These play the role of mortgage insurance rates and you can protect your own bank for folks who try not to help make your repayments.

You could also rating increased interest rate when forgoing a beneficial downpayment. This could improve one another the payment plus much time-name notice will cost you rather. Guarantee that you adjusted your allowance of these added costs whenever choosing one among them finance.

Yes, particular authorities-recognized home loan programs allow eligible consumers to track down home financing rather than a down-payment, regardless of if most other will set you back such settlement costs and higher rates of interest s that need tiny off payments (as little as 3%, oftentimes).

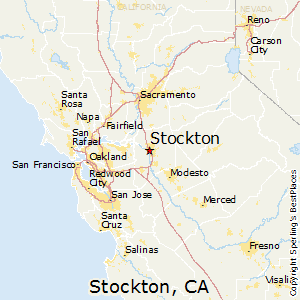

Va and you may USDA money will be the fundamental zero downpayment choices in america. The brand new Va mortgage program is only having army pros, effective service participants, and select spouses, together with USDA financing program is actually for use in certain outlying and you will suburban portion.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile