A credit score off 650 is fair and should meet the requirements you for the majority of home loans, along with antique funds centered on your income.

If you have a great 650 credit rating, it’s natural so you can inquire if or not now is a lot of fun to rating a home loan otherwise whether increasing your credit history earliest was finest. What’s promising? You can be eligible for several types of mortgage loans which have a beneficial 650 credit score. The latest not so great news? You could potentially shell out a high interest rate than just anybody with a good an effective otherwise decent rating. Continue reading to resolve, “How much cash off home financing must i score having a beneficial 650 credit score?” to suit your condition.

The most common credit score design, the new FICO rating, ranges out of 300 so you can 850. A credit history of 800 to 850 is outstanding, if you find yourself a rating of 579 otherwise quicker is recognized as terrible. Around, a credit history regarding 670 to 739 are categorized as good, if you’re results one are priced between 580 and you may 669 are believed reasonable. Sixty-eight percent from People in the us have fico scores of good or more, and that is you, too.

A credit history off 650 is within the deluxe off the new fair assortment. Having really works paying off loans, to get a third party user otherwise which have a lease revealing team, you’re able to improve credit score to your a good diversity.

Whenever loan providers agree your loan app, they appear at issues eg complete obligations, debt-to-earnings proportion, your credit rating and you can credit score. Every one of these make a difference the maximum mortgage approval matter and you may financing terms. Which have a top credit score, you might be eligible for a bigger loan, all the way down interest or more positive installment conditions.

Though some loan providers deny a mortgage software when you yourself have an excellent 650 credit score, you could be eligible for a normal financial or that loan supported from the Government Casing Government (FHA), Pros Affairs (VA) otherwise U.S. Service away from Agriculture (USDA) loan with this rating.

You might be eligible for a traditional financing which have a credit score out-of 620 or even more, thus an excellent 650 credit history will be enough for those who fulfill the fresh new lender’s almost every other standards. Simply how much resource you can purchase is dependent upon your earnings, obligations, debt-to-earnings ratio or other affairs including the down-payment matter. Which have a top money, straight down obligations-to-income ratio, and downpayment from 20% or higher, you can be eligible for a more impressive traditional financing.

If you sign up for a normal compliant mortgage, the most amount borrowed for the majority of your own U.S. are $766,550, having highest restrictions in a few high-cost portion.

Government-backed FHA fund want the very least credit history off five-hundred in order to 580. You may need a credit rating with a minimum of 580 in order to secure the mortgage with just a beneficial step 3.5% downpayment. The complete recognized amount borrowed may vary by private products. The fresh new Company out-of Houses and you may Metropolitan Development’s limits to own unmarried-family home mortgage wide variety in the 2024 start from $498,257 to help you $step one,fifteen mil.

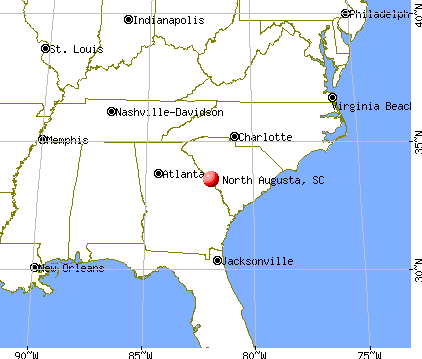

USDA funds are an alternative bodies-recognized mortgage alternative. The lending company will have to would a full credit opinion in the event the your credit score was less than 640, thus that have a credit history regarding 650, just be able to be considered for people who satisfy almost every other conditions. So you can qualify for the USDA loan system, you ought to meet maximum income requirements and buy a house inside the a qualifying rural area. USDA limitation home loan restrictions vary of the urban area but are $377,600 in the most common of the nation.

Va money, supplied by the brand new Service from Experts Items, are around for active and you can seasoned armed forces team and their partners. According to Va, there’s absolutely no lowest credit rating requirements, but some Va lenders want a credit rating of at least 620. An excellent 650 credit score might be sufficient to qualify for a good Va real estate loan for people who meet up with the almost every other Virtual assistant financing criteria, along with provider requirements.

Interest levels normally change, nevertheless they possess has just be much more erratic in the modern markets. As you cannot yourself control industry rates, you can find products inside your handle which can affect the variety of regarding home loan you are able to be eligible for.

step 1. Latest Obligations Levels – A high credit history and you will money cannot guarantee approval having a loan; loan providers also consider your debt-to-income ratio. That it ratio suggests a beneficial borrower’s power to would obligations, and a lesser proportion is much more good. Consumers should become aware of the DTI and you will work with reducing debt or expanding money to improve the odds of mortgage recognition.

2. Downpayment – Down money will help cure an excellent lender’s chance giving good sense of defense whether your debtor non-payments toward financing. When a debtor sets down a lot of money upfront, he’s got alot more invested in the home or investment, making them less inclined to walk away from their investment decision. That it reduces the odds of https://paydayloancolorado.net/gunbarrel/ the lender taking a loss on the experiences away from a standard. The brand new deposit and acts as a demonstration of borrower’s economic stability and you may ability to conserve, that further reassure the financial institution concerning borrower’s capability to pay-off the loan. Fundamentally, off payments serve as a safety level to own lenders against potential losings.

step three. Amount of Earnings – With respect to applying for a mortgage, your earnings plays a crucial role inside the deciding the amount of money you to loan providers are willing to lend for your requirements. Lenders typically comply with a rule one to states your own monthly housing expenditures should not meet or exceed 28% of terrible monthly money. Thus the greater your revenue, the better the mortgage amount you may also be eligible for.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile