Property Guarantee Mortgage (HELOAN) should be an appartment on of cash which you take-out in the some point eventually & you’re pay concept and you will appeal on that money. You’re not going to get access to the money more and you will over again as you can be having a property Equity Distinct Credit (HELOC). A credit line is also planning to save some costs since we do not know exactly how much they you prefer and how far they wish to use. Having a beneficial HELOC you might remove what you prefer a tiny simultaneously & pay only desire thereon matter. Which can save a king’s ransom throughout the enough time work with. You could have up to a decade to view one line out of borrowing more than once. This provides you the felxibility in order to without difficulty accessibility money whenever brand new monetary need arise.

Whether you are sending a close relative to school, you want to make some renovations or combine obligations, otherwise surprise bills has come upwards, you long term installment loan lenders can access your house’s security by using aside the second mortgage. Perhaps the property value your residence has grown, you have been and make payments on your own home loan for some time, or a variety of each other – either way, you based beneficial collateral of your house.

There are 2 methods to supply the equity, by using out property security loan (HEL), otherwise using a home guarantee credit line (HELOC). These are known as 2nd mortgages and are never to getting confused with an earnings-aside home mortgage refinance loan. The difference may sound subtle, but when you might be advised and you will evaluate family security financial loans, you can choose which mortgage ‘s the right one for the state.

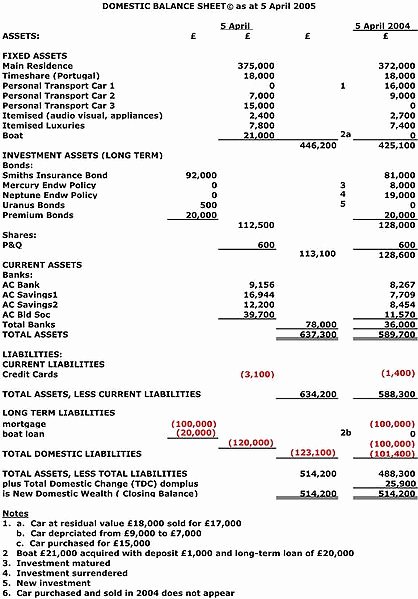

Influence their equity of the deducting the bill you borrowed from on your own home loan in the reasonable market price of your home and property. Loan providers use a loan-to-worthy of ratio (LVR), the total amount your already are obligated to pay in your house while the number we would like to acquire, versus their worth, to decide whether they tend to grant your another financial.

Please be aware that simply such as your first mortgage, you are getting your home upwards since equity to possess an additional mortgage. The advantage of the second financial, when compared to other types of money, is the relatively lower interest.

The initial matter you need to wonder before carefully deciding this new within 2nd financial options try, Create I need a lump sum payment right now to pay a primary expenses, otherwise can i access dollars sporadically? The next real question is, Perform I plan to shell out this loan away from quickly, otherwise do I plan to make payments for an extended period?

A beneficial HELOC is a line of credit, the same as what you receive from a credit card providers. Your acquire the amount you want when you need it, and you also shell out desire only into amount your use. Usually, HELOC money keeps a varying rate of interest that’s subject to raise otherwise drop-off. These rates is linked to new abilities out-of a certain list, also a margin, that is detailed on the HELOC loan data files. This is why your own monthly lowest financing commission you may improve otherwise drop-off throughout the years.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile