If you find yourself paying down your home loan early to help you has more month-to-month earnings, you’ll have a sense of how you’ll use that more currency. If you want to cut fully out your own $900 homeloan payment and invest $900 per month with its put, that would be a great utilization of the money.

In the course of time, it is your responsibility how-to spend the more funds. But if you are unable to think of what you want to perform toward currency, or if you might invest it towards the frivolous commands, repaying their financial early may not be a knowledgeable monetary circulate.

If you know we want to remain in that it domestic while in the old-age, using it well now and that means you won’t need to generate month-to-month costs within the senior years might be the right flow.

But if you’re, say, ten years away from advancing years and you may haven’t come paying yet, paying will be a far greater utilization of the money than purchasing off of the mortgage early.

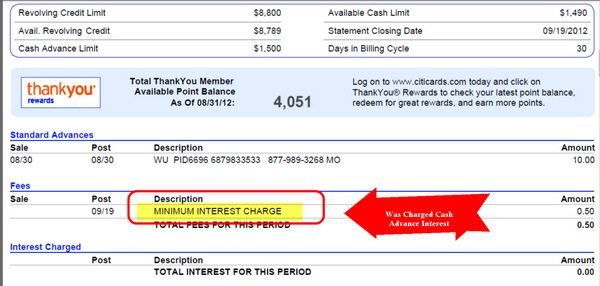

The entire guideline is that you will be focus on paying off large-attention obligations in advance of all the way down-attract personal debt. You will be spending a higher level on credit cards or private education loan than simply in your financial, thus you would work with a lot more by paying men and women out-of very early.

Usually do not pay so much into the your own higher-desire financial obligation which you risk defaulting on the mortgage repayments, though. Yes, credit cards will be high priced, as well as the issuer can take suit for those who default to your credit payments. However, defaulting with the mortgage payments is an even bigger risk, because you you will definitely clean out your house.

If you are searching to help you ultimately provide some room on your month-to-month finances otherwise save money on desire, while making even more repayments in your financial isn’t their only option.

Refinancing helps you lower your monthly installments, either by lowering your rate or by stretching the loan label you have more time for you repay your debts.

If the paying down your loan very early ‘s the mission, refinancing toward a smaller label will help you make that happen while spending less on the desire.

For those who have a great number of money we should place for the your home loan, you may want to think a lump sum otherwise mortgage recast.

Having a lump sum payment, you create you to highest payment with the their prominent so your financial would be paid off early. But with a beneficial recast, you only pay one to exact same lump sum payment and get your own financial determine exacltly what the monthly payment is going to be predicated on your brand new, down dominating number. Then you will have a similar title duration however, a lesser month-to-month payment moving forward.

There’s no obvious best otherwise wrong respond to about no matter if you will want to pay off the mortgage very early. This will depend on your own state plus individual requires.

Explore our very own totally free mortgage calculator to see just how paying down your own financial very early make a difference your finances. Plug on the wide variety, upcoming click on “Info” to have factual statements about investing most monthly. It’s also possible to use an have a peek at this web site algorithm to determine your monthly dominant percentage, though playing with a mortgage calculator tends to be smoother.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile