There are sorts of do it yourself financing and every happens having its individual benefits and drawbacks. We’re going to shelter for each and every financing method of so you’re able to choose which household upgrade loan is right for you.

The amount of money away from a keen unsecured personal bank loan come into one to swelling share and so are normally paid back from inside the repaired installment payments. They don’t want collateral. Signature loans normally fundamentally be used getting some thing.

A home guarantee credit line (HELOC) allows you to make use of the guarantee of your house just like the collateral. When you have collateral in your home, so it lower-appeal secure financing can be a better choice for your.

A finances-out refinance replaces your existing mortgage with a new one to have more the a fantastic loan harmony. You withdraw the difference between the two mortgage loans for the dollars. You’ll be able to make use of the bucks to have home remodeling, merging large-attention personal debt, or any other economic requires.

House security money is shielded by guarantee of your house. Therefore, if not make your monthly obligations, the financial institution will require your residence to settle the debt.

FHA 203(K) finance are supplied by the You.S. Company of Houses and you will Metropolitan Invention (HUD). Such funds are a great choice for individuals who have to have the most detailed repairs into a house.

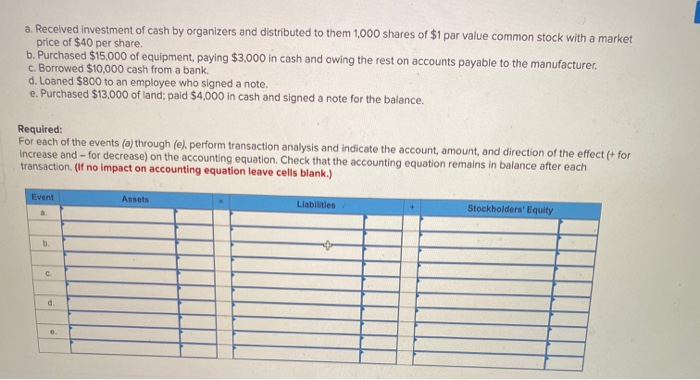

Qualifying to have property improvement mortgage is much like trying to get an even more standard personal bank loan. You’ll want to bring your public protection count and so the financial is eliminate your credit history. The higher your credit score, the higher interest, and you may mortgage terminology it is possible to qualify for.

Lenders also want to see you have uniform earnings, very rating a few monetary documents ready to fill in. Depending on their bank, this might include latest tax returns, lender comments, and/or pay stubs.

Your earnings compared to the your debt debt is also thought to be section of the application. The lower the monthly personal debt repayments versus your earnings, this new large loan amount you could qualify for.

If you’re having difficulty qualifying to have an unsecured loan, you may want to speak to your local borrowing connection. Credit unions have an informed home improvement loan rates, particularly if you reduce than just average borrowing.

The lending company may also consider the particular home improvement opportunity you may be completing into loan funds and how it will include for the worth of your residence. It could be one thing behind the scenes like new insulation, brand new window, or foundation fix.

Alternatively, you could also explore home improvement finance to upgrade things graphic of your home, instance a kitchen area otherwise bathroom remodel. Pools, decks, and the newest improvements may be prospective do it yourself projects that have your loan fund.

Eventually, you should talk to for each particular bank to be sure the need home improvement venture qualifies. They generated features constraints toward structural items, otherwise they could be lenient which have how you make use of your fund.

The total amount you could borrow hinges on what kind of loan you choose. Which have a guaranteed mortgage, for example a house security loan, you can borrow larger amounts of money than just you could potentially having a personal loan, such as for instance an unsecured loan.

Lowest credit score conditions vary by the financial and you may believe multiple issues such as mortgage kind of and loan amount. For personal fund, minimal credit history is normally doing 660. Although not, you can get a bad credit mortgage having less credit history, but it will also come with a top rate of interest.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile