Credit money is stabilized on the American society, and in addition we often do it very recklessly. Inside the 2020, an average Western got $twenty-five,483 inside personal debt, not including mortgages. Using up that much obligations may have dreadful effects, especially if you acquire throughout the incorrect bank. For the bequeath regarding on the web financing, it is hard to separate the favorable regarding the crappy. While you are currently into hunt for a new financial, make sure to do thorough browse before you apply. If you are considering Bridge Lending Choice, opinion so it overview of the business basic. Here is what you must know to determine regardless of if you should obtain from them.

Link Lending Possibilities was a consumer home loan company you to specializes in on the internet, small-buck, cost financing. He’s extremely liberal underwriting process as they are happy to really works with individuals who have poor credit.

Regrettably, they fees significantly because of their properties. Even they accept that they are merely useful to anybody whose backs try contrary to the wall structure economically. Instance, they say they’re a viable provider when someone are unable to pay for the lease, automobile fixes, or scientific costs. If that sound familiar, it is because pay-day loan providers result in the same says. In fact, the essential difference between an instant payday loan and that kind of repayment loan is negligible.

Really the only high adaptation between the two kind of fund was you to fees funds provides expanded fees terminology. Bridge Credit Choices doubles down on determining the products it makes in that way because of the concentrating on its payment freedom. They have multiple installment times one to purportedly remind consumers to spend from other loans as quickly as possible (and prevent notice).

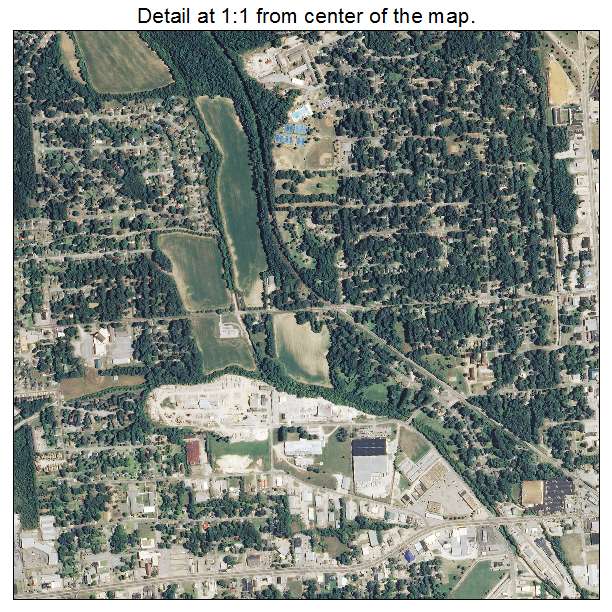

Connection Financing Solutions’ head office are in Wisconsin, nonetheless services out-of a local American scheduling from inside the Lac du Flambeau. This is why, they don’t have (or thought they need) a license in the state.

These include a good tribal lender, meaning that they’re an expansion away from a native American group and only esteem their regulations. Connection Financing Selection belongs to the Lac Du Flambeau Selection of Lake Advanced Chippewa Indians, as well as their only licenses are in the tribe.

Once the an extension off a beneficial Federally Approved Indian Group and you will Sovereign Country, he’s got tribal immune system. In simple terms, this means it is nearly impossible to help you sue him or her. Most tribal loan providers have fun with its reputation to quit condition statutes, specifically those you to reduce rates of interest they may be able fees.

Like any on the web tribal loan providers, Connection Financing Options just shows exactly what the tribal position means in the the latest terms and conditions, and this notes the next: We’re entirely compliance which have tribal financing laws and you may relevant government credit statutes. We’re not necessary to realize condition laws and regulations and you may feel limited by new terms of the latest contract having Bridge Financing Properties together with tribal legislation.

Government laws and regulations dont manage far to protect users out of usurious lenders. You to obligations lays on states, so that the simple fact that Link Financing Choices willfully ignores condition guidelines was hazardous.

Link Credit Choices is less imminent using their terms than of several of their competition. They don’t promote a variety of prices on their website otherwise also a typical example of a normal loan. Consumers wouldn’t discover every pertinent details up to they rating a duplicate of the loan agreement.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile