If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue. Intuitively, the degree of operating leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs. Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes. The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs.

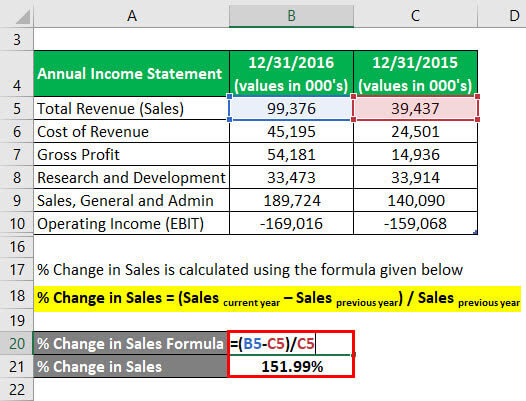

For example, if your DOL was 1.25% in 2021 but dropped to .95% in 2022, it would mean your profit has decreased. In essence, it’s costing you more to produce something than you’re earning in profits. If you want to calculate operating leverage for your competitors—but don’t know all the details about their finances–there’s a way to do that. This method uses public information–and can be helpful to investors as well as companies checking out their competition.

However, the downside case is where we can see the negative side of high DOL, as the operating margin fell from 50% to 10% due to the decrease in units sold. If revenue increased, the benefit to operating margin would be greater, but if it were to decrease, the margins of the company could potentially face significant downward pressure. If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded. However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible.

Operating Leverage is a financial ratio that measures the lift or drag on earnings that are brought about by changes in volume, which impacts fixed costs. Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise.

After its fixed development costs were recovered, each additional sale was almost pure profit. In contrast, a company with relatively low degrees of operating leverage has mild changes when sales revenue fluctuates. Companies with high degrees of operating leverage experience more significant changes in profit when revenues change. The benefit that results from this type of cost structure is that, if sales increase, the company’s profits will also increase correspondingly. In fact, the relationship between sales revenue and EBIT is referred to as operating leverage because when the sales level increases or decreases, EBIT also changes.

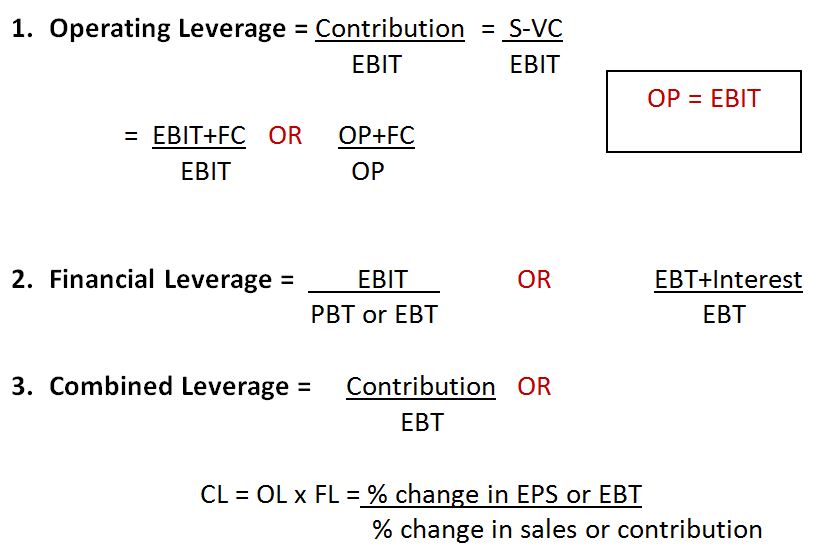

On the other hand, if the case toggle is flipped to the “Downside” selection, revenue declines by 10% each year, and we can see just how impactful the fixed cost structure can be on a company’s margins. Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs. It’s a good idea to measure a firm’s leverage ratios against past performance and with companies operating in the same industry in order to better understand the data. A leverage ratio is a type of financial measurement used in finance, business, and economics to evaluate the level of debt relative to another financial metric. It can be used to measure how much capital comes in the form of debt (loans) or assess the ability of a company to meet its financial obligations.

Operating leverage is one of the more important considerations when analyzing a company, but it is one of the more underutilized ideas. The better operating leverage a company owns, the quicker it can scale up as it grows, and the lower the leverage; the opposite is true. Also, the operating leverage metric is useless in some industries because it fluctuates too much or cannot be reasonably calculated based on public information.

For illustration, let’s say a software company has invested $10 million into development and marketing for its latest application program, which sells for $45 per copy. Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range. A company with how to create bank rules in xero a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment. A second approach to calculating DOL involves dividing the % contribution margin by the % operating margin.

This approach produces 2.0x for the software company vs. 1.0x for the services company, which understates the operating leverage differences. Selling each additional copy of a software product costs little since the distribution is almost free, and no “raw materials” are required (just support costs, infrastructure/bandwidth, etc.). For example, software companies tend to have high operating leverage because most of their spending is upfront in product development. Operating leverage can be high or low, with benefits and drawbacks to each. When given the choice, most businesses would prefer to have a higher DOL, which gives them more flexibility, though it also means more risk of profits declining from a drop in sales.

Completa i campi per ricevere un preventivo

Descrivi ciò di cui hai bisogno. Il nostro staff prenderà in consegna la tua richiesta e ti risponderò nel minor tempo possibile